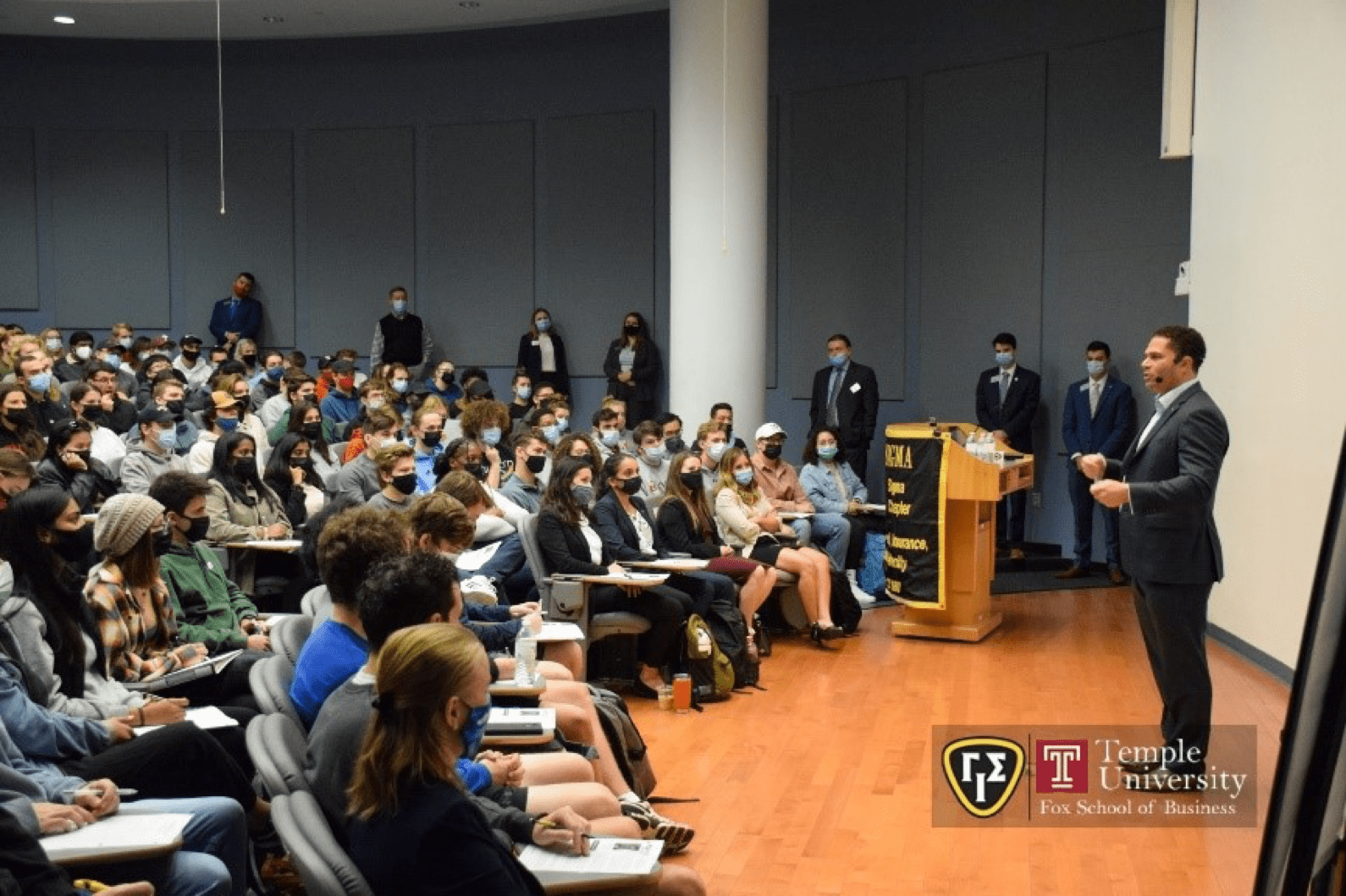

With more than 20 years’ experience in the insurance, reinsurance and finance industries, Kael Coleman, founder and CEO at insurance and reinsurance brokerage firm Protecdiv, was well placed to share his entrepreneurship journey with students at the Fox School of Business at Temple University – the next generation of business leaders.

When I talked to business students at Temple University, I looked back on my personal and professional life for examples of entrepreneurship and business success – and the four lessons I’d learned along the way.

I started my first entrepreneurial venture when I was ten and walked to school. Most mornings I’d pick up some gum at the store but realised that the kids that took the bus to school never could. I started selling them a piece for 25 cents and given the pack of five cost 50 cents, I had a near arbitrage.

Looking back, I learned the first of the four lessons when the school told me to stop selling on school grounds – you must operate within the rules of the game you’re playing.

My second attempt at entrepreneurship was when I was 13 and started a skateboard shop with my best friend. We loved skateboarding but had to travel to a surf shop three towns over when we needed new equipment. He and I used his mom’s business license and savings and bought wholesale skateboard equipment. We made what to us was a fortune – close to $1,000 each in a few month – but then we just stopped. We hadn’t expected this kind of success and didn’t know what to do next.

The second lesson: you need a plan.

I was 21 when I tried my next venture with three friends – a spring break company that offered a full itinerary and excellent 24-hour customer service. We folded after one year as we all had different ideas about the future. We were all strategic thinkers, so nobody wanted to do the day-to-day work.

The third lesson: you’ve got to be with the right people. Not just people you like, not just smart people, but the right people in the right roles.

My last entrepreneurial venture before my current one was when I was 28. I was a trader at a large firm and decided to set up a hedge fund with a friend. The problem was, we didn’t have any sales expertise. Turns out you must sell the fact that you’re a good trader, not just BE a good trader.

Lesson number four: you’ve got to sell.

In short, my four key messages to the business students were: you’ve got to know the rules of the game you’re playing, have a plan, be with the right people, and you’ve got to sell.

In the insurance industry the rules of the game are rules of regulation, rules of convention, and rules of opportunity. The rules of regulation are legally required and are enforced by the likes of state regulators and insurance rating agencies.

The rules of convention are the unwritten rules that govern the way we do business, such as going through brokers to get to clients.

The rules of opportunity arise when the way we do business shifts because of factors such as technological advances, new data, and social changes.

Having a plan is important if you’re going to set up your own business – but equally so if you work with a big company. If you don’t have a plan and set goals within a time frame, you’ll be at the mercy of others.

Being with the right people – it’s important to align with like-minded people, but also work with a diverse team of people with different perspectives, experiences and skills.

Selling, too, is important in both corporate and entrepreneurship environments. You must think about what the customer – or your boss – wants and try to give it to them.

I wanted to convey to these future entrepreneurs the importance of being able to adapt to unplanned complications, and the dedication you need to seize opportunities. These are vital attributes for business growth and empowerment.